Fair market value calculator stock

You should invest in stocks that have a higher fair value than the current market price. Ad Confidently Trade Any Market Direction.

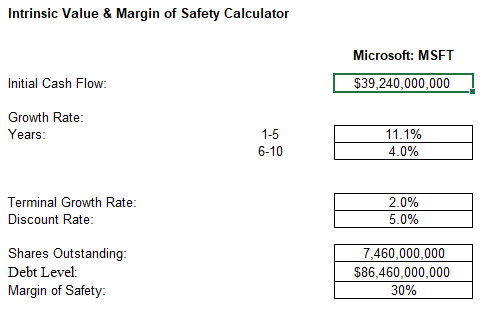

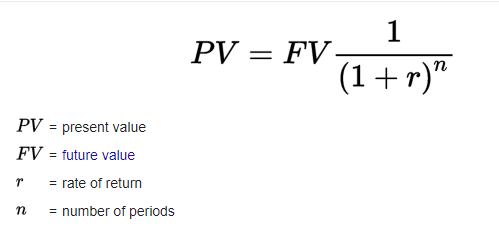

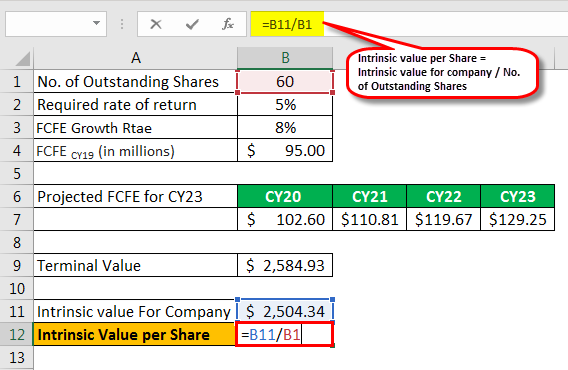

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Net income for the company fell 72 year-over-year to 656 million.

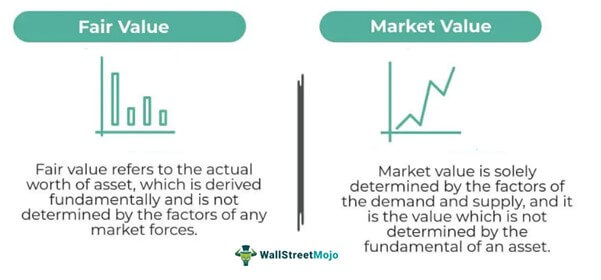

. The fair market value of the property and fair market value of stock determination is different from FMV calculation for business. Fair market value FMV is the price that an asset would realistically sell for on the open market. Join The Worlds Largest Investing Community.

Ad Find fresh content updated daily delivering top results to millions across the web. Historically the companys dividend has grown by 3 yearly and your expected rate of return is 12. Build Your Future With a Firm that has 85 Years of Investment Experience.

Stock Fair Value Calculator and Intrinsic Value Calculator Evaluate a company in the stock market. The fair value of a stock is determined by the market where the stock is traded. Multi-Stage DDM Calculator for Stocks Fair Value The Dividend Discount Model DDM is a method that calculates a companys stock price based on the sum of all future.

If you calculate fair value to be 100 and you used a 12 percent discount. A ratio above 100 indicates that the stocks. Build Your Future With a Firm that has 85 Years of Investment Experience.

Visualize the price series of the stock and compare market price to fair price. The IRS uses FMV to calculate the value of gifts. The Premium Tool automatically calculates the fair price of the stock.

Calculate Fair Market Value. Shares of Nvidia were down more than 2 following the announcement. That is the stock may be quoted at one price and its.

The Premium Tool automatically calculates the fair cost of the stock. The valuation based on the average PE ratio from June 2010 would result in a fair value of only 17360 USD because the. Fair market value FMV is in its simplest expression the price that a person reasonable interested in buying a given asset would pay to a person reasonably interested in.

The result is a fair value based on the PE ratio of 21543 USD. You should invest in stocks that have a. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Ad Access The Latest Impartial Financial Information on Stock Market. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Say you want to buy 100 shares of some company and the last closing price of their stocks was. Trades Backed by Technical Analysis Win More Often. Fair value also represents the value of a companys assets and liabilities when a subsidiary.

Fair value is the price you can pay and expect to generate your required rate of return in that stock. The intrinsic value of a stock is basically its fair price however in most cases this value differs from the market quotation. The graph shows the ratio price to fair value for the median stock in the selected coverage universe over time.

Install the 397 version. Bull Trends Bear Trends or Sideways. Before getting started youll need the following.

Check out all advantages within the. This is displayed in the premium area for each stock on the stock detail page. Use respectable financial news and find the last closing price for the stock you want to buy.

Ad Do Your Investments Align with Your Goals. Find a Dedicated Financial Advisor Now. 20 billion versus 20 billion expected.

Stock fair value 30 012. The PE ratio is the ratio of the current market price of a stock and its earnings per share EPS. Find powerful content for what is my stock worth.

Try Premium for Free Today. The PE ratio tells an investor how much price they are paying for every 1 earned. The process is in-depth and time.

Here is how you can calculate its fair value.

Value Shares With Graham S Formula

How To Calculate The Intrinsic Value Of A Stock Excel Calculator

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

/ScreenShot2022-03-08at4.53.06PM-eda6eb2099b245129240ed8ef9d984ed.png)

Book Value Vs Market Value What S The Difference

Peter Lynch S Stock S Fair Value Calculator With Formula Khanz Invest

Market Value Definition What Is Market Value

How To Calculate Intrinsic Value Formula Excel Template Amzn Example Sven Carlin

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Fair Value Meaning Formula Stocks How To Calculate

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

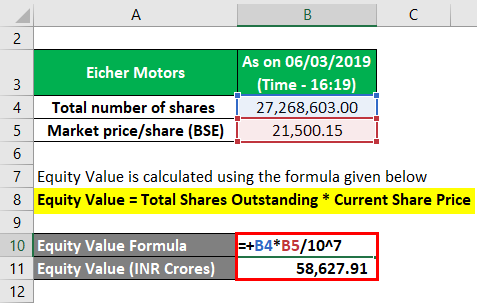

Equity Value Formula Calculator Excel Template

Intrinsic Value Formula Example How To Calculate Intrinsic Value

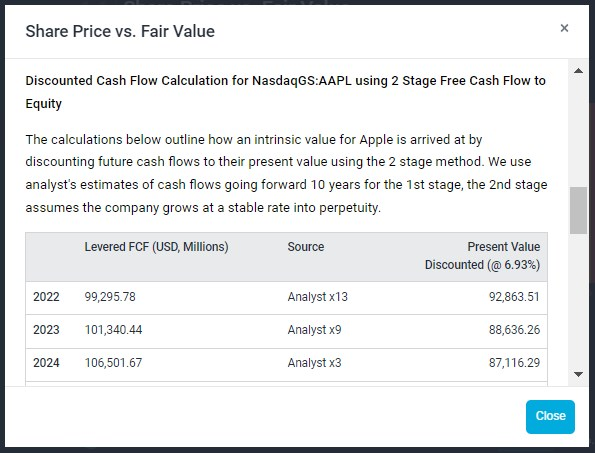

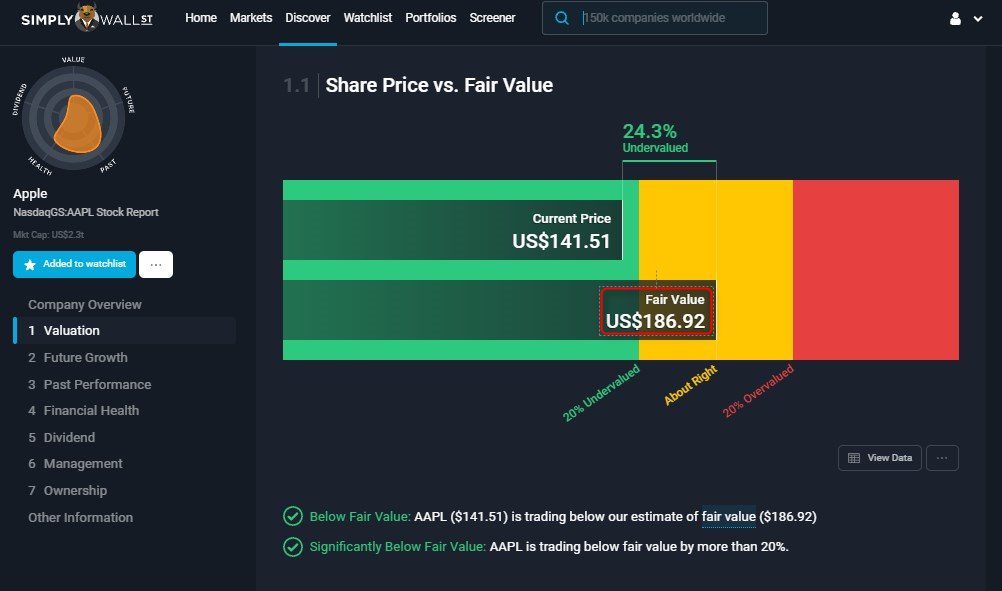

How Is Fair Value Calculated Simply Wall St Help Center

How To Calculate Asset Market Value 15 Steps With Pictures

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

How Is Fair Value Calculated Simply Wall St Help Center

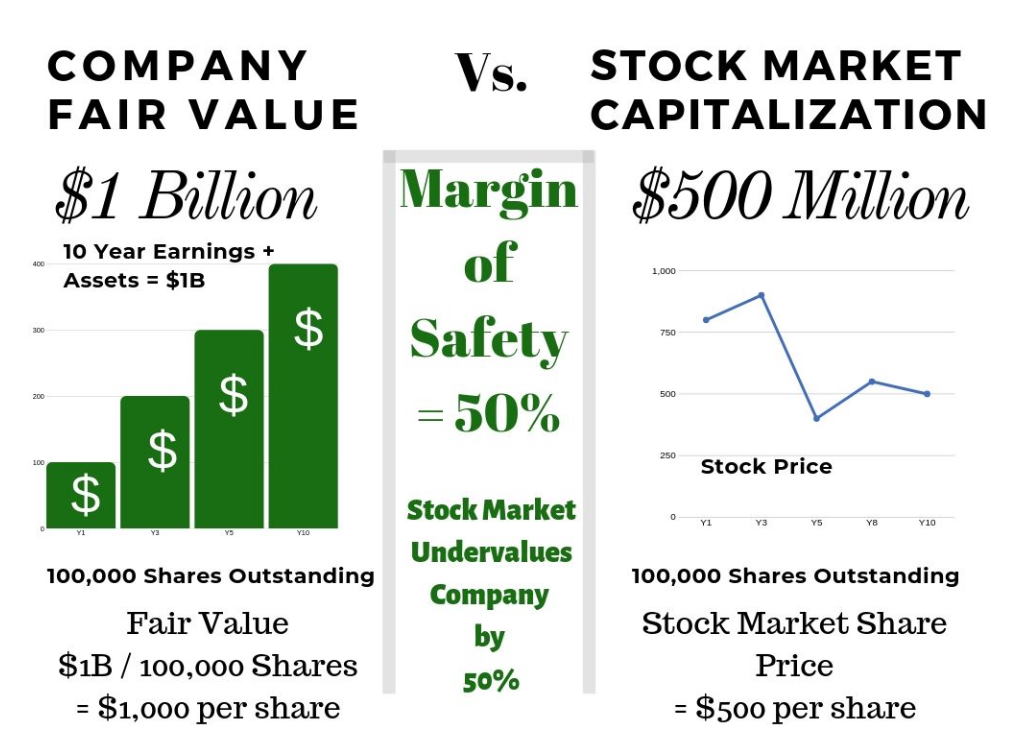

How To Calculate Warren Buffett S Margin Of Safety Formula Excel